We can help you with:

Legal optimization in high-taxation areas

Registration of companies and international bank accounts

Changing tax residency to the best options today

Cryptocurrencies

Protection of assets

E-commerce, Amazon FBA and online businesses

We analyze the details

First of all we will analyze in detail what you want to achieve.

We create an action plan

Determinaremos todas las limitaciones y propondremos soluciones

Implementation and ongoing support

We execute and maintain the structure

Get your freedom

Leaving a high-tax country like Spain can be difficult

Many people mistakenly think that going out and being outside is enough...

There are many factors that need to be analyzed:

- Family ties

- Economic ties

- Establishment of a new address with the possibility of obtaining a tax certificate

- Properties

- Personal and business exit tax…

Creation of Companies, Foundations and Trusts

To start or relocate a business

We will analyze multiple options depending on where you live or want to live, business needs, income level...

We create an action plan

We will determine all the limitations and propose solutions

We will analyze multiple options depending on the time you want to stay, region of the world, income level...

Bank accounts, brokers and international exchanges

Asset protection

The added value we offer:

Who is this service for?

Ideal for...

Entrepreneurs and business owners who are fed up with the constant theft of taxes and want to take action to optimize within the law.

People who want to break away from their country of origin and find a new optimal tax residence

People who want to protect their assets and avoid taxes such as donations or inheritance taxes.

Not for you if...

Yo think than your high-tax country has a solution and the economic/business situation will improve

You don't want to have bank accounts abroad and only trust local banks

Compress years into minutes

Learn from my successes and failures in this world

TIME is your MOST VALUABLE asset and especially with taxation and international optimization it is often difficult to understand all the rules and keep up to date with how everything is changing. Save yourself the thousands of headaches I have had in figuring out the best ways to proceed.

AVOID FINES by not using a correct structure.

Does your current international structure comply with the CFC rules, company residence rules, effective management rules, rules against non-taxation of hybrid entities, transfer pricing rules and permanent establishment rules in your country of residence?

FAQ:

Why this service and not go directly to the managers of the necessary country?

You need someone who has a global vision and not just a vision of the destination country.

If you come from a high-tax country, you will be faced with many contingencies and knowing how to fit all the pieces together is highly complex.

In addition, in most cases, where you create a company or reside are different places and local managers will only be interested in selling you their local structure, without putting forward the solutions that would really suit you best.

If I don't want to leave the country, can this be useful to me?

If you do not want to change your tax residence, you especially need this individual planning service because these are the most complex cases.

Are your trusted contacts and advisors licensed?

Yes! We work with the best experts in all the jurisdictions you may be interested in to optimize taxes.

What payment methods are available? Can I receive an invoice in the name of a company?

Payments can be made by bank transfer, credit or debit card or crypto. If you are a company or self-employed, we can invoice you without any problem.

+1000

Clients helped with changes of residence and tax optimization

+20M€

in taxes saved across all customers

+25

Countries where we work to help you in residences/companies/banks

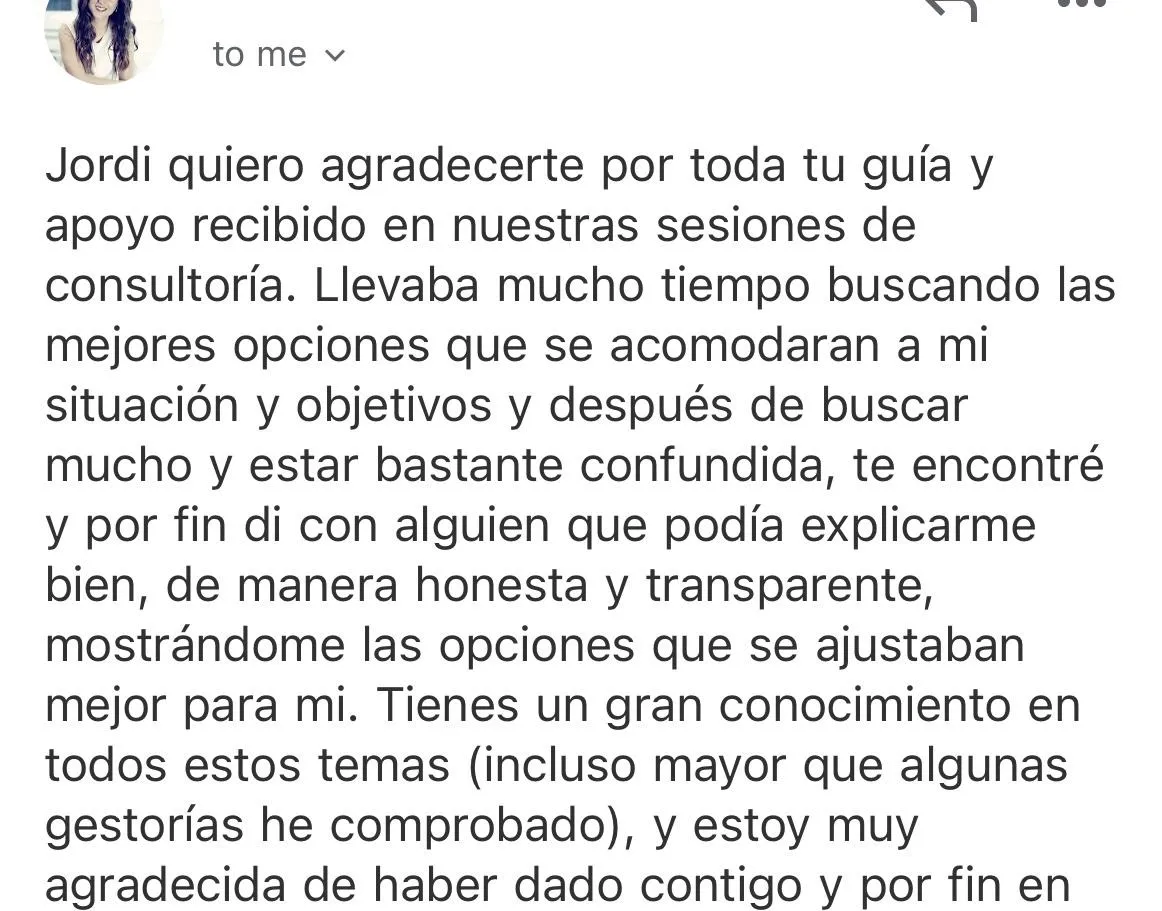

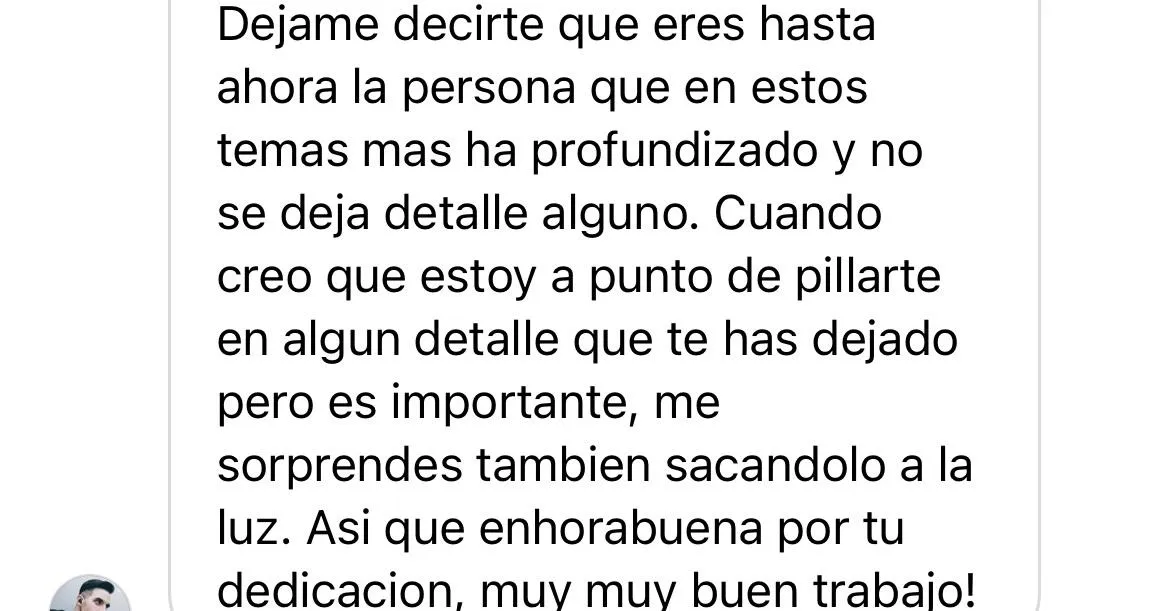

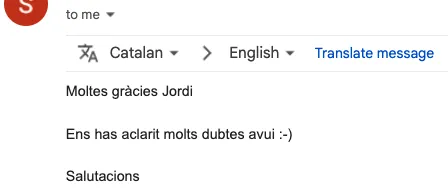

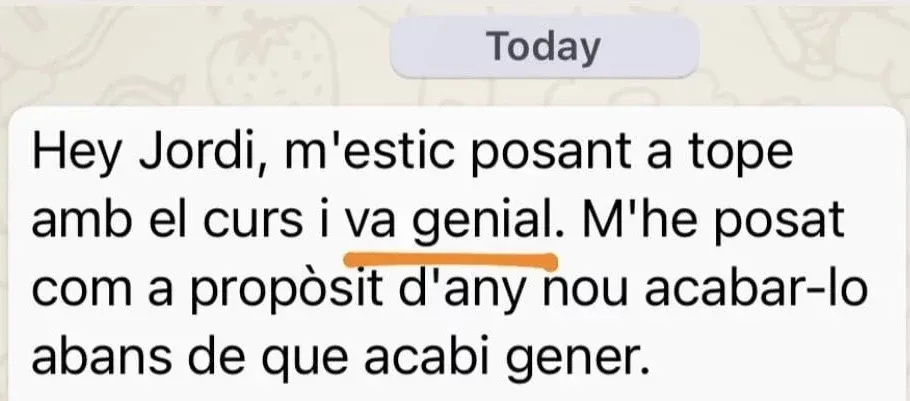

Some testimonials from my training and consultancies:

Pay less taxes legally

The best time to start optimizing was yesterday. The second best time is TODAY.

© Copyright Jordi Farràs 2025. All rights reserved.